Japan’s beauty market stands as a formidable force in the global cosmetics industry, with a staggering value of USD 35 billion in 2022. This powerhouse shows no signs of slowing down, as projections indicate growth to USD 36.93 billion by 2029. What’s particularly intriguing is how this market seamlessly blends centuries-old beauty traditions with cutting-edge innovations, creating a unique ecosystem where ancient herbal remedies share shelf space with AI-powered skincare solutions.

Table of Contents

Toggle

Japan’s beauty and personal care market continues to showcase its significance in the global economy. In 2022, this vibrant market was valued at a strong USD 35 billion. While there have been some ups and downs, projections show that the cosmetics segment is expected to settle around USD 27.5 billion in 2024. The growing focus on natural and organic products has become a defining characteristic of consumer preferences.

Despite the current challenges, the outlook is bright. Experts anticipate growth, with estimates suggesting the market will reach approximately USD 36.93 billion by 2029. This optimism is rooted in the spending habits of consumers, who invest an average of USD 334.30 each year on beauty products. The resilience of this sector is noteworthy, reflecting a continued commitment to personal care.

Looking beyond the immediate future, analysts predict a consistent growth rate, with a compound annual growth rate (CAGR) of 4.2% through 2033. If these projections hold true, the market could expand to about USD 39.9 billion. This steady trajectory exemplifies Japan’s vital role in the global beauty industry, even in the face of economic uncertainties. In this ever-evolving landscape, the appreciation for traditional beauty techniques, such as *uguisu no fun*, continues to charm a modern audience, ensuring that Japan remains a beacon of beauty innovation.

Japan’s beauty market continues its upward trajectory, fueled by the explosive growth of digital commerce which now accounts for over 20% of total sales. The market’s expansion reflects a perfect storm of technological innovation, with virtual try-ons and AI-powered skincare recommendations redefining how consumers discover and purchase products. This digital overhaul, combined with the rising demand for personalized beauty solutions and sustainable products, positions Japan’s beauty sector for substantial growth through 2030. The industry’s robust performance is evident in its projected growth from USD 31.16 billion to reach USD 35.90 billion by 2028.

The beauty market in Japan, the third-largest economy in the world, presents an encouraging outlook. Currently valued at approximately USD 22.85 billion in 2023, projections suggest a steady rise towards USD 31.82 billion by fiscal year 2031. This growth translates to a compound annual growth rate of 4.23%, reflecting the market’s resilience.

In particular, the segment dedicated to natural and organic cosmetics shows remarkable promise. Expectations indicate that this area will expand from USD 1,328.75 million to USD 2,264.03 million by 2032. With a compound annual growth rate of 6.10%, it surpasses the general market growth, highlighting a clear shift in consumer preferences towards clean beauty and sustainable options. The emergence of smart beauty devices has revolutionized the industry by providing personalized skincare recommendations through AI-powered skin analysis.

Even amidst challenges like market saturation, these figures exemplify Japan’s beauty industry adaptability. It continues to evolve alongside consumer demands while reinforcing its status as one of the leading cosmetics markets globally. As one who appreciates the art of beauty, the unfolding trends signify an important cultural movement towards thoughtful and eco-conscious choices in self-care.

Digital innovation is reshaping Japan’s beauty industry at an impressive pace. By 2023, online channels are anticipated to contribute 18.3% to the sector’s overall revenue. This transformation is greatly supported by Japan’s remarkable internet penetration rate of 89.8%. Such connectivity allows for heightened digital experiences enhanced by AI-driven personalization and virtual try-on technologies, which are becoming integral to how consumers engage with beauty products.

Social media plays a significant role in influencing consumer choices. Research indicates that 62% of beauty shoppers depend on influencer strategies for discovering new products. Among the various platforms, Instagram is at the forefront; approximately 80% of beauty enthusiasts use it daily to explore cosmetic options. The multi-step skincare routines are commonly practiced by Japanese consumers seeking optimal results. The ongoing COVID-19 pandemic has acted as a catalyst for these trends, pushing traditional retailers to adopt direct-to-consumer models and bolster their online presence.

In this evolving landscape, tech-savvy millennials and Generation Z are at the helm of the digital shift. They enthusiastically embrace smart beauty devices and personalized skincare solutions, reshaping expectations within the industry. By adapting to these advancements, one can witness a truly transformative moment in the realm of beauty, honoring both tradition and modernity.

The Japanese beauty market showcases a clear hierarchy with skincare dominating the terrain, projected to reach an impressive $18.41 billion by FY2031. While premium brands maintain their stronghold in traditional department stores and specialty shops, mass-market products are finding increasing success through both brick-and-mortar and digital channels. The emergence of e-commerce has altered the distribution terrain, yet Japan’s unique beauty culture still maintains a harmonious balance between online convenience and the personalized service of traditional retail outlets. The market’s steady expansion at a 5.15% CAGR reflects strong consumer demand and technological innovation in the skincare sector.

Japan’s skincare segment stands proud, with a market value of $17.1 billion in 2021. This impressive figure underscores the nation’s enduring influence in the global beauty landscape. Expected growth is projected at over 1% CAGR through 2026, driven by innovative skincare solutions that artfully merge traditional ingredients with state-of-the-art technology. A glimpse into this trend reveals a strong emphasis on anti-aging and brightening products, which resonate deeply with discerning consumers.

Facial care products take center stage in Japanese consumer preferences, dominating both value and volume metrics. Renowned companies such as Shiseido, Kao, and KOSÉ have effectively responded to these sophisticated demands. Their offerings reflect an increasing interest in natural ingredients and a commitment to sustainable beauty. Quality holds great significance in Japanese culture, making it a key factor in the skincare routine. The rise of e-retailers as leaders in distribution has transformed how Japanese consumers access their favorite beauty products.

As a practitioner of traditional Japanese beauty, I appreciate how the meticulous nature of these skincare rituals invites efficacy and innovation to harmoniously dance together. This unique fusion sets the bar for global beauty standards, nurturing a marketplace that continually evolves while respecting its roots. Each product tells a story, woven from the wisdom of generations, embodying both tradition and modern elegance.

In Japan, beauty consumers navigate a harmonious blend of premium and mass-market products, crafting a unique experience where luxury meets everyday practicality. On one hand, premium brands like Clé de Peau Beauté deliver advanced formulations and exquisite packaging, appealing to those who appreciate refined beauty rituals. On the other hand, mass-market products offer affordability and accessibility, serving as essential items in the daily routines of many.

Examining the differences between these categories reveals distinct pricing and distribution strategies. Premium items often come with a higher price point, a reflection of the extensive research and high-quality ingredients that go into them. The premium product category dominated the market in 2023, driven by increasing consumer spending and demand for organic beauty products. Consumers are aware that investing in such products can elevate their beauty regimen. In contrast, mass-market offerings prioritize widespread availability and competitive pricing, ensuring that everyone can find a reliable cleanser at their local store.

This dual approach is a testament to Japan’s rich beauty culture. Many individuals find joy in indulging in luxury serums while remaining committed to their trusted drugstore favorites. This balance demonstrates a pragmatic mindset toward beauty, one that values both quality and practicality in daily self-care. The thoughtful choices made by Japanese consumers reveal a deep understanding of their own beauty needs, combining the best of both worlds.

As a practitioner of traditional Japanese beauty care, I observe the landscape of our retail environment with great interest. In Japan, beauty consumers find themselves navigating a vibrant world where cherished brick-and-mortar shops perfectly blend with the swift ascent of e-commerce platforms. By 2023, digital sales are anticipated to account for 18.3% of total beauty revenue, signaling a noteworthy shift in consumer behaviors. Yet, traditional retail remains resilient, as brick-and-mortar stores continuously refine their approaches to meet evolving customer needs.

Parapharmacies and drugstores continue to hold a pivotal role in offline distribution, offering a sense of familiarity and trust. This steadfast presence is complemented by the allure of e-commerce platforms, which entice shoppers with appealing prices and the convenience of home delivery. The gap between urban and rural accessibility has started to close, thanks to the expanded reach of online shopping. It’s particularly heartening to see younger generations, such as Millennials and Gen Z, propelling the growth of digital sales with their preference for modern conveniences. With face make-up emerging as the dominant category in 2021, retailers across all channels have adapted their displays and marketing strategies accordingly.

This harmonious coexistence of online and traditional channels paints a rich picture of Japan’s unique market dynamics. Consumers cherish the tactile experience of interacting with products in-store while simultaneously embracing the ease offered by digital platforms. Such a balanced retail ecosystem illustrates how adaptability and appreciation for diverse shopping experiences can shape the future of beauty in Japan.

The beauty landscape in Japan is indeed a fascinating blend of tradition and innovation. Leading this vibrant industry is Shiseido Company, Ltd., a name that resonates deeply with quality and heritage. Close behind are Kao Corporation and KOSÉ Corporation, both of which have firmly established their presence through cutting-edge technological advancements and a diverse range of products.

With a keen eye on consumer preferences, these companies skillfully combine time-honored methods with modern science. Take Pola Orbis Holdings, for instance; they have embraced artificial intelligence to create personalized skincare solutions, tailoring their offerings to individual needs. In a similar vein, Fancl Corporation has introduced augmented reality technology into their beauty simulators, making it easier for customers to experience their products firsthand and enhancing overall engagement. The Japanese beauty market is experiencing remarkable growth, with a market value of $35 billion in 2022.

The dynamics of this marketplace reflect a commitment to maintaining high standards while adapting to ever-changing consumer desires. Each of these industry leaders contributes to Japan’s esteemed reputation for exceptional cosmetics and skincare, ensuring that time-honored practices are not only preserved but also evolve to meet contemporary demands.

In Japan, the beauty market is quite fascinating, influenced by the nuances of regional characteristics that reflect the rich tapestry of our culture. Major metropolitan areas, such as Tokyo in the Kanto region, play a crucial role in the industry’s growth, driven by high disposable incomes that elevate the demand for luxury cosmetics. The market currently stands at USD 27.5 billion and continues to show remarkable expansion potential.

Yet, if one ventures into Kyushu and Okinawa, you’ll discover a preference for UV protection products. This reflects not only lifestyle choices but also an acute awareness of the sun’s impact on skin health. Tohoku is intriguing, with consumers there showing a penchant for skincare items that leverage local ingredients, showcasing the connection between beauty and regional heritage.

Meanwhile, central regions like Nagoya maintain a robust logistical framework that ensures efficient distribution, benefiting a wide array of consumers. With Japan’s aging population, there’s a marked influence on product development, especially in areas focused on anti-aging and solutions tailored for mature skin.

As we look at market segmentation, it’s essential to highlight the shift toward gender-specific offerings. The rise of male grooming products is notable, as society embraces diverse beauty standards, including unisex lines that cater to all. This evolution reflects a broader understanding of beauty, harmonizing traditional values with modern expectations.

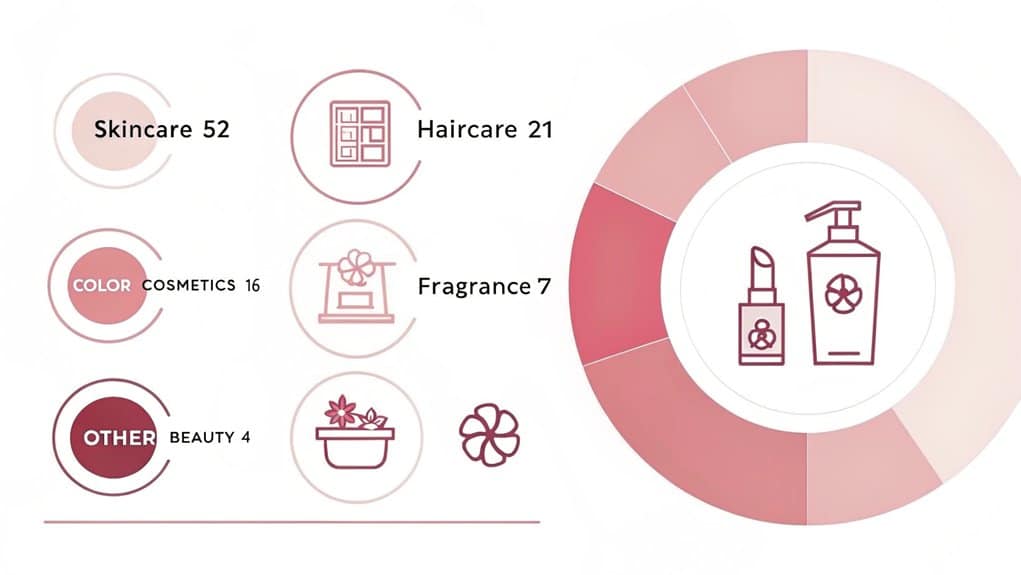

The skincare sector in Japan proudly serves as a cornerstone of the beauty industry, boasting a remarkable market value of $17.1 billion as of 2021. This figure accounts for over half of the nation’s cosmetics market, showcasing a cultural significance that deeply values the pursuit of flawless skin and meticulous skincare practices. Japanese beauty emphasizes J-beauty routines that focus on achieving shiny, moisturized skin while minimizing the use of beautifying cosmetics.

As consumer preferences evolve, the growth of this sector continues apace. Facial care items lead both in value and in volume, revealing a trend towards prioritizing effective and cherished products. Blending time-honored ingredients like sake lee and green tea with modern formulations allows for innovative approaches to skincare. Additionally, take note of the professional skincare segment, which is projected to soar to $12.2 billion by 2024, highlighting substantial growth opportunities.

Looking to the future, the sector anticipates a compound annual growth rate (CAGR) of 4.18% through 2033. This momentum particularly highlights the increasing interest in natural and organic products, as consumers become more discerning about what they apply to their skin and seek effective solutions. Such insights can guide you toward making informed choices in your own skincare journey, emphasizing the importance of both tradition and innovation in achieving radiant skin.

The beauty market in Japan has undergone significant transformation due to digital change. E-commerce platforms are now on track to account for 18.3% of the total industry revenue by 2023. This shift has changed the way in which consumers discover, evaluate, and purchase beauty products. The pandemic played a crucial role in accelerating these online shopping behaviors. Companies are increasingly focusing on introducing products with natural and clean labels to meet evolving consumer preferences.

In the realm of digital beauty, several developments stand out. AI-powered virtual try-ons and personalized recommendations have become integral tools that help users find products suited to their needs. Engaging with consumers through social media has also proven effective, as 62% of beauty buyers follow influencers for inspiration and advice. This direct connection not only fosters a sense of community but also influences purchasing decisions. Direct-to-consumer models have emerged, allowing brands to respond quickly to shifting market demands. Additionally, the expansion of cross-border e-commerce provides Japanese consumers with easier access to international brands.

Major brands like Shiseido and L’Oréal are at the forefront of these trends. They are investing significantly in their digital platforms while using social media to create vibrant brand communities. This approach facilitates stronger customer loyalty, crucial in a market that is becoming increasingly tech-savvy. As the fusion of tradition and technology continues, the essence of Japanese beauty care remains cherished, even as it adapts to new innovations.

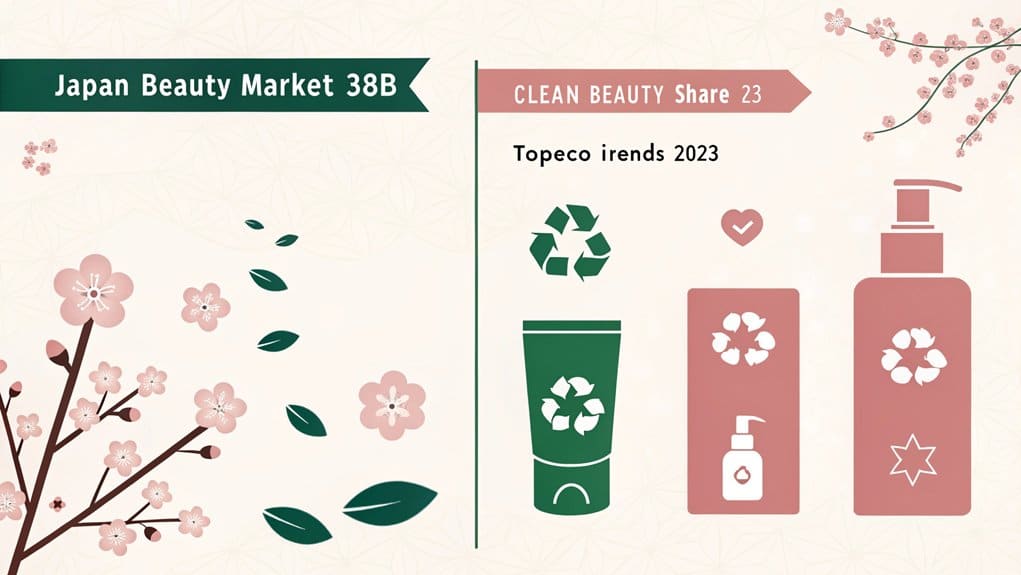

The beauty landscape in Japan is undergoing a notable transformation, as more consumers embrace sustainability and seek out clean, eco-friendly products that truly resonate with their values. This shift is reflected in the natural and organic cosmetics market, which is projected to achieve a remarkable USD 2,264.03 million by 2032. It’s clear that eco-friendly initiatives are becoming integral to brand strategies, and this development deserves our attention.

The market is experiencing a 6.10% CAGR from 2024 to 2032, demonstrating the strong momentum behind this sustainable beauty movement. Brands committed to clean beauty are responding adeptly to this emerging demand. Industry leaders like Shiseido are taking significant strides by introducing sustainable lines such as Baum. This particular line boasts an impressive 90% tree-derived formulation, showcasing how companies are prioritizing nature in their products.

The growing awareness around health and wellness also plays a pivotal role in this shift. Research indicates that 18% of consumers are now actively pursuing eco-conscious brands, while 16% are making it a point to select recyclable packaging. This wave of sustainability reflects a deeper movement, influencing consumer choices and shaping Japan’s beauty landscape in a way that values minimalist routines and natural ingredients over synthetic options.

As this evolution continues, it’s fascinating to witness how traditional principles of beauty and care resonate with modern preferences. The pursuit of simplicity and purity aligns closely with the age-old practices that Japanese culture holds dear, reminding us that sustainability in beauty is not just a fleeting trend but a meaningful transformation in how we approach self-care.